Some Ideas on Arc Insurance Car Insurance You Should Know

Table of ContentsThe Ultimate Guide To Arc Insurance Motorcycle InsuranceThe Only Guide to Arc Insurance Car InsuranceThe Ultimate Guide To Arc Insurance Motorcycle InsuranceHow Insurance Agent Cincinnati can Save You Time, Stress, and Money.

If you create a vehicle accident, you may be responsible for any type of costs connected with it. This includes legal costs, clinical expenses, and also shed revenue. Without particular kinds of protection, you would likely pay for these expenses out of your pocket. Likewise, if your automobile is damaged, the insurance covers the expense to either replace or repair it.According to the Insurance Coverage Details Institute, the typical yearly cost for an auto insurance plan in the USA in 2016 was $935. 80. Usually, a single head-on accident can cost thousands of dollars in losses, so having a policy will set you back less than paying for the crash. Insurance additionally aids you prevent the decline of your car.

Numerous aspects impact the expenses: Age of the automobile: Oftentimes, an older car prices less to insure compared to a more recent one. Brand-new vehicles have a higher market price, so they cost more to fix or replace. Components are less complicated to locate for older lorries if fixings are required. Make and also model of automobile: Some vehicles set you back even more to insure than others.

Arc Insurance Car Insurance Fundamentals Explained

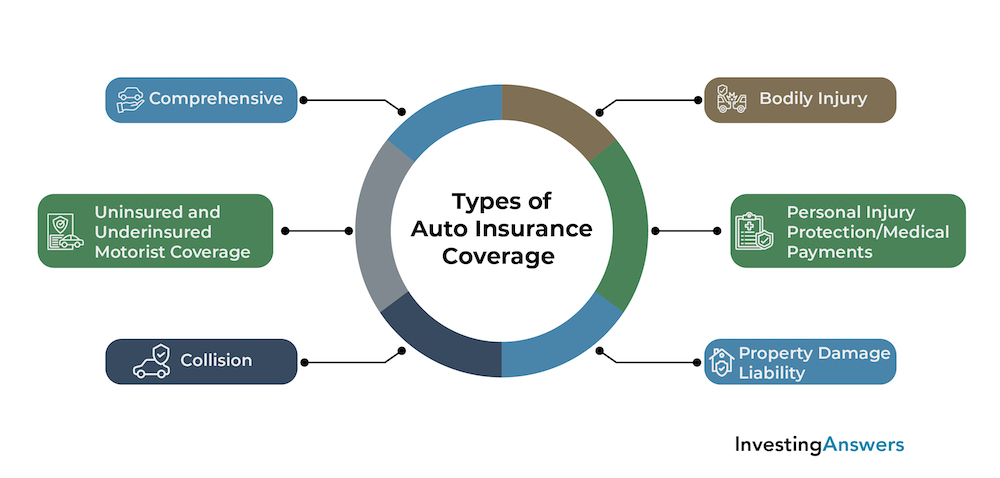

Danger of burglary. Certain lorries routinely make the frequently stolen lists, so you may need to pay a higher premium if you own one of these. When it concerns automobile insurance coverage, the 3 major types of policies are obligation, collision, and detailed. Obligatory obligation protection spends for damage to one more vehicle driver's automobile.

Some states need drivers to lug this protection. Underinsured driver. Comparable to without insurance protection, this plan covers damages or injuries you suffer from a driver who does not carry sufficient coverage. Bike protection: This is a policy specifically for motorcycles since vehicle insurance policy does not cover motorcycle accidents. The advantages of auto insurance coverage much outweigh the risks as you might wind up paying countless bucks out-of-pocket for an accident you create.

It's normally far better to have even more insurance coverage than not sufficient.

Many classic automobile insurance companies likewise provide unique coverages for points like presenting your vehicle at automobile shows, as well as having competence in the fixing of unique lorries. Making use of timeless auto insurance policy might come with downsides, such as gas mileage limitations, and also only particular autos are qualified for a timeless cars and truck insurance policy.

Things about Insurance Agent Cincinnati

This could be anywhere from $10,000 to $100,000 or even more it's all dependent on what your classic automobile deserves, as established by an appraiser. This remains in contrast to the means regular automobiles are insured. If you have a frequently offered auto, your insurance company will certainly identify its value based upon similar models and also the price to fix it.

The other main benefit of classic car insurance coverage is that these companies specialize in collaborating with uncommon, collection agency or antique cars. The representatives, insurers and also various other personnel you'll connect with when you have a classic automobile policy will certainly be familiar with the ins and also outs of an uncommon cars and truck, as well as extra knowledgeable about the requirements of a vintage car proprietor.

Including pulling just with a flatbed check tow truck to prevent deterioration while transferring to a service center or back home. In situation a person sustains an injury at an exhibition click this or event including your car. Offers insurance coverage while you are away from your car as it is being shown, such as at a car show.

Classic automobile insurance coverage isn't designed for vehicles you use each day or ordinary vehicles like a recent Toyota or Volkswagen (Car Insurance Cincinnati, OH). Timeless cars and truck insurance providers normally require that there's something special concerning the car, such as innovative age, high worth or some customization. Generally, your car needs to come under at least one of the adhering to groups: A minimum of 25 years old Modern muscle mass automobile Unique Tweaked vehicle It's also likely that your automobile will require to fulfill all of the following demands in order to certify: In great condition Parked in a secure and also totally enclosed garage, carport, storage center or other authorized structure Not used for day-to-day travelling Not used for competing Driven no even more than 7,500 miles per year (differs by insurance company) In addition, there are typically certifications that you, the proprietor of the automobile, must fulfill.

What Does Car Insurance Cincinnati, Oh Do?

While most collectible car insurance plan are reasonably similar, the way providers identify various sorts of collectible lorries, including some kinds they omit coverage for, is very important to recognize. Although definitions, years as well as descriptions can vary from insurance provider to insurance company as well as one state to another, one of the most usual collectible automobile classifications are listed below.

Specified by several firms as being 19 to 24 years of ages, brought back, in good functioning problem and more than the average value of other automobiles of a knockout post the very same year; some insurance providers consider a cars and truck of this description that is only above 10 years old to be "timeless." The Classic Automobile Club of America concerns classic cars to be those manufactured in between 1925 and 1948 (Motorcycle Insurance Cincinnati, OH).